European City Pulse

European City Ranking

Residential investment should not be country-focused. Successful strategies in a globalised and urbanising world must focus on cities and regions.

Currently, 56% of the world’s population resides in cities and by mid-century, seven out of ten people will be urban residents. Cities generate 80% of global growth and wealth, cementing their status as economic powerhouses, with their influence only set to increase in the coming decades.

However, cities also face significant challenges, including social divisions, economic inequality, demographic shifts and environmental issues. Understanding the drivers that make a city competitive and attractive to businesses and residents is crucial for developing a successful long-term investment strategy. Addressing these challenges and leveraging urban strengths can lead to more sustainable and profitable investments.

Our local experts, including our fund and asset managers, want an edge on the competition to drive value for our clients. They leverage the Index to comprehensively understand the cities where they live and operate and compare them to the European city universe. This tool enables them to identify each city's unique strengths, anticipate future developments and craft strategies that maximize returns. By understanding the evolving dynamics of urban environments, they ensure informed decision-making and optimal investment outcomes.

Marcus Cieleback

Chief Economist, PATRIZIA

City Ranking Factors

To understand the evolving urban landscape and emerging issues and challenges, PATRIZIA has developed a comprehensive city ranking system based on market fundamentals, location quality, innovative capacity and connectivity. This system uses a blend of quantitative and qualitative indicators, carefully identified and weighted for 142 cities across Western Europe.

Four sub-rankings reflect the intricate relationships between these factors. These sub-rankings are then aggregated, with additional weighting, to form the final PATRIZIA European City Ranking. This approach provides a nuanced understanding of each city's strengths and potential, helping to inform strategic decision-making and optimise investment returns.

Market Fundamentals Ranking Breakdown

Population describes the number of people resident within a geographical area and a given timeframe.

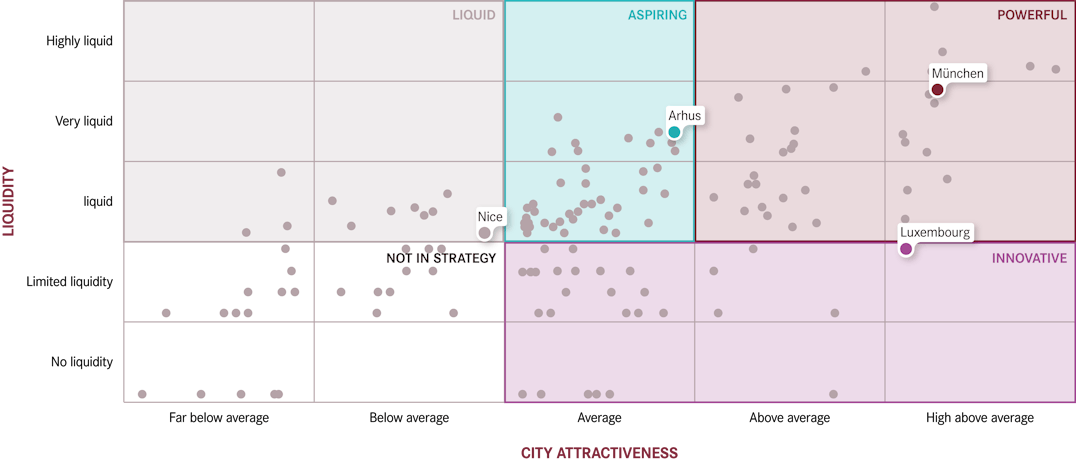

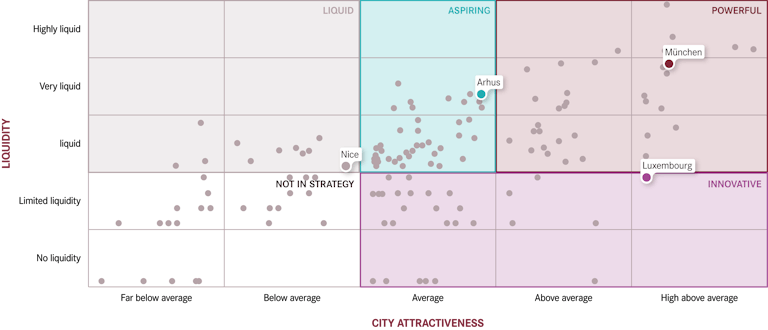

City Clustering for Strategy Optimisation

Assessing a city's attractiveness is the initial step in crafting an effective investment strategy. Understanding market liquidity is crucial for investors, as it influences how swiftly capital can be deployed and how actively portfolio management can enhance property value over time.

To this end, the PATRIZIA European City Ranking includes a liquidity indicator derived from recorded transactions. This metric reveals the activity level of the institutional residential market in each city over the past four years, providing investors with insights into market dynamism and the potential for active management and value appreciation as their investments mature.

The Four Investment Strategy Goals

Cities with economies that dominate their respective country or region are defined as powerful. London and Paris, for example, are powerful cities not only because of their sheer size, but also because of the significant role they play in the daily life of their nations. Stockholm, although far smaller than Paris or London, plays a similarly significant role in the context of Sweden’s economy. Due to their relative size powerful cities typically have a relatively liquid residential market that - given the dominant local economy - tends to be more expensive than the residential market of other city clusters.

PATRIZIA European City Ranking Combined with a

Residential Market Liquidity Index

Combining these two dimensions - ranking and liquidity - for the 142 cities results in a 25-field matrix that enables investors to identify target cities for a given strategy/risk-return requirement.

Looking at Examples, the Benefit of the Matrix Becomes Obvious.

The capital of Sweden is a powerful city because of its prime position in the country’s economic, civic and political life. It also has a favourably young demographic profile with one of the fastest growing populations in Europe while ranking highly in terms of connectivity and innovation.

Property prices in Stockholm have doubled over the last 15 years. For long-term investors, Stockholm offers opportunities to benefit from the continuing development of the local institutional residential market as the city is clearly on a growth path. However, the challenge will be to find suitable assets for the supply is limited.

The European City Pulse

Focused Views

Using tools generated from the matrix data, investors can zoom into different views of the cities in the Index and identify and compare key aspects of the 15 Featured Cities.